In recent years, DEXs (Decentralized Exchanges) based on the AMM (Automated Market Maker) model have witnessed vigorous development. However, for those who engage in frequent trading, although the AMM model averts the risk of entrusting assets to centralized participants, it still suffers from issues like high gas fees, being ill-suited for large-volume transactions, and providing a poor user experience. The Ethereum OG, Gwei, also pointed out in Twitter Spaces that while the AMM model excels in gas efficiency, its trading pattern fails to meet the criteria of Product - Market Fit (PMF). In contrast, the order book model boasts advantages such as flexibility, high capital efficiency, and the capacity to execute various intricate trading strategies via APIs. He believes that with the enhancement of blockchain throughput, decentralized trading will ultimately revert to the order book model. This is precisely the reason why he opted to become a Degate Evangelist.

This article delves into several representative projects, some of which are still in the exploratory phase, while others have already vanished. Perhaps we can glean some insights from them.

Bitshares: The Foundation Stone of DeFi Development by the Founder of EOS

In 2014, Dan Larimer introduced the first decentralized exchange, BitShares. BitShares brought forth a series of novel concepts, many of which have been adopted by subsequent DeFi projects. Firstly, BitShares launched a market-pegged asset system that encompassed bitUSD, bitEUR, bitCNY, and the like. The value of these assets on the BitShares platform was on a par with that of real currencies. For instance, 1 bitUSD was equivalent to 1 USD, yet it necessitated the native token BTS of BitShares as collateral for endorsement, with liquidation being automatically executed by smart contracts to ensure payment capabilities. Secondly, BitShares employed the Delegated Proof of Stake (DPoS) algorithm, enabling holders of BTS to partake in the network’s operation and decision-making. Each BTS token functioned as a vote, and the top 101 holders with the most votes were entitled to package and settle transactions, thereby reaping handling fees. Additionally, BitShares harnessed a technology known as Graphene to accelerate transaction processing, and the transaction fees were remarkably low, with each transaction costing less than $0.01.

Despite the fact that the transaction fees and speed of BitShares were comparable to those of centralized exchanges, it did not progress as anticipated. One possible reason was the exorbitantly high cognitive and educational costs for users regarding this novel type of exchange. Moreover, BitShares merely transplanted the order book trading format onto the blockchain, lacking in allure.

BitShares underwent a fork in 2020. The cause was that some developers modified the code of the voting system during the BTS 4.0 version upgrade without seeking the community’s vote, which incited dissatisfaction and controversy within the community. Subsequently, Dan Larimer, the founder of BitShares, introduced the smart contract blockchain EOS, touted as the “Ethereum Killer” in 2018.

Etherdelta: A Simple Model with Performance Bottlenecks

In June 2017, EtherDelta officially commenced operations and had completed the registration formalities with the US Securities and Exchange Commission prior to its launch. Similar to Bitshares, Etherdelta was also an order book DEX. On EtherDelta, users could issue, revoke, and match buy and sell orders through trading contracts, all the while being required to pay gas fees. Once the counterparty clicked on an order, the trading contract would automatically deduct the buyer’s assets and dispatch them to the seller. All transactions transpired on the blockchain and were recorded by smart contracts, while users’ assets remained stored in their respective wallets. Additionally, EtherDelta levied a 0.3% trading fee, which was borne by the buyer. Although EtherDelta boasted low trading fees and rapid trading speeds, it was not without its problems. For example, the process of matching transactions demanded manual intervention from users, the throughput limitations of Ethereum led to sluggish trading speeds, and delays in the order book could result in transaction failures and a waste of gas fees.

Notwithstanding these issues, thanks to its straightforward model and the growth of the Ethereum ecosystem along with the elevation of user education, EtherDelta amassed a considerable number of users and a substantial trading volume within less than a year of its launch. Regrettably, in October 2017, EtherDelta fell victim to a hacking incident, with at least 308 Ethereum and other tokens with a potential value of hundreds of thousands of dollars being stolen. Subsequently, the US Securities and Exchange Commission accused it of violating the Securities Exchange Act.

The founder, Zachary Coburn, consented to reach a settlement with the regulatory body and paid a fine of $388,000. Subsequently, Zachary Coburn sold EtherDelta. On February 18, 2017, it was reported that EtherDelta had suspended trading. On February 19, 2017, the founding technical team of EtherDelta announced a fork and launched a new trading platform called ForkDelta.

Loopring: The First Launched ZK Rollup, Focusing on Differentiation Factors

With the advent of the DeFi boom, the issue of transaction throughput on the Layer 1 network came to the fore, prompting DEXs to explore expansion onto Layer 2. Loopring was launched towards the end of 2017. It was the first Ethereum ecosystem DEX protocol constructed based on ZK Rollup, leveraging ZKP (Zero-Knowledge Proof) technology to achieve high throughput and non-custodial trading. Loopring has undergone multiple iterations. Its initial version solely supported limit order trading. The second version fortified privacy and security by introducing ZKP technology, and the third version incorporated support for the AMM mode, thereby enhancing the liquidity of the DEX.

It can be observed that Loopring combines the narratives of DEX and ZK. In terms of performance, Loopring utilizes ZKP technology to complete all matching logics off the chain and then submits proofs to the chain by generating them, thereby ensuring both the efficiency and the security and validity of transactions. Additionally, Loopring has introduced an order sharing mode. When the smart contract is unable to execute the entire order in a single transaction, this function will dissect the order into smaller segments for trading until the original order amount is fulfilled. Specifically, the on-chain trading ring matching technology of Loopring aggregates multiple individual orders into an order ring. After the smart contract verifies the orders, each participating party exchanges assets according to the rules of the order ring. The order sharing system continues to run until all partial orders are completely executed. For example, if investor A desires to sell token A, investor B wishes to buy token A and sell token B, and investor C desires to buy token B and sell token C, such a trading cycle will persist until investor A obtains the required currency. This trading cycle can guarantee the optimal price for all trading participants and also procure a higher level of liquidity.

In terms of security, Loopring ensures that each off-chain matching generates a proof and submits it to the chain via ZKP technology, thereby demonstrating that the result is correct. Moreover, even in the event of the exchange being shut down, users can still assert the legality of their assets by providing valid Merkle proofs, which can be obtained from the data on the Ethereum. However, Loopring currently holds a security level of STAGE 0 on L2Beat, primarily due to the lack of an exit window. The Loopring team has also indicated in a conference call that they are currently endeavoring to create a security committee and are committed to enhancing the security level on L2Beat and planning to undertake some updates to provide users with more layers of security protection.

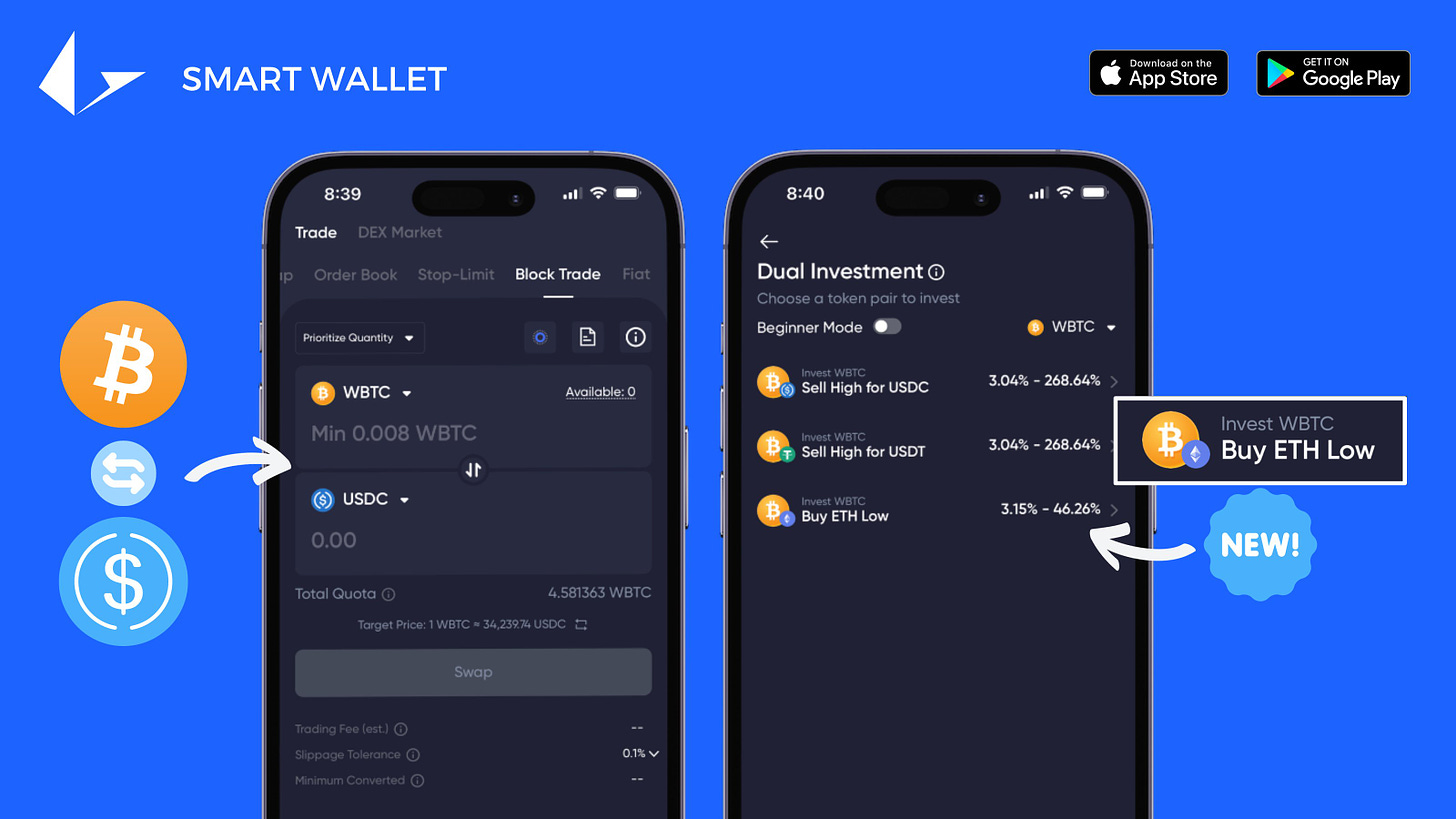

Compared with other DEXs, Loopring places greater emphasis on differentiation factors, thereby launching numerous new functions and products to bestow unique experiences upon users. For example, it embeds support for the Loopring ZK Rollup scheme within the smart wallet product; opens up fiat currency channels, enabling users to recharge effortlessly through credit cards and bank cards; launches functions similar to bulk trading in the traditional stock market and provides a complete set of Layer 2 NFT solutions, including open casting, limit order trading, and transfer, etc. Additionally, it is worth noting that Wang Dong, the founder of Loopring, and Brecht Devo, the former chief architect of Loopring, jointly founded the EVM-equivalent ZK Rollup project Taiko in 2017 and completed a $15 million Series A financing in March this year, led by Lightspeed Faction, Hashed, Generative Ventures, and Token Bay Capital. Currently, Taiko has completed a cumulative financing of $37 million through three rounds of financing.

dYdX: Focusing on the Derivatives Market and Committed to Achieving Fully Decentralized Operation

Another DEX that migrated to the Layer 2 network due to the throughput problem of the Layer 1 network is dYdX. Unlike Loopring, dYdX concentrates on the derivatives market and opts to build based on the StarkEX L2 solution provided by StarkWare. Initially, dYdX was deployed on the Ethereum mainnet and was merely a margin trading protocol. However, with the skyrocketing of Ethereum gas fees, dYdX was unable to bear the user’s gas fees, so it decided to migrate to Layer 2 and established a trading system based on the order book.

The reason for choosing the StarkEX L2 solution of StarkWare is that it better meets the needs of dYdX. This solution can not only batch process transactions but also is compatible with various smart contracts. Although developing applications on Starkware requires learning its specific language, Cairo, compared with its other advantages, its advantages are more attractive, including significantly reducing gas and trading fees, allowing traders to use a single margin account to conduct multiple perpetual contract transactions, thereby enhancing capital efficiency when trading multiple token pairs, enabling cross-margin and higher scalability, and permitting real-time liquidation, etc.

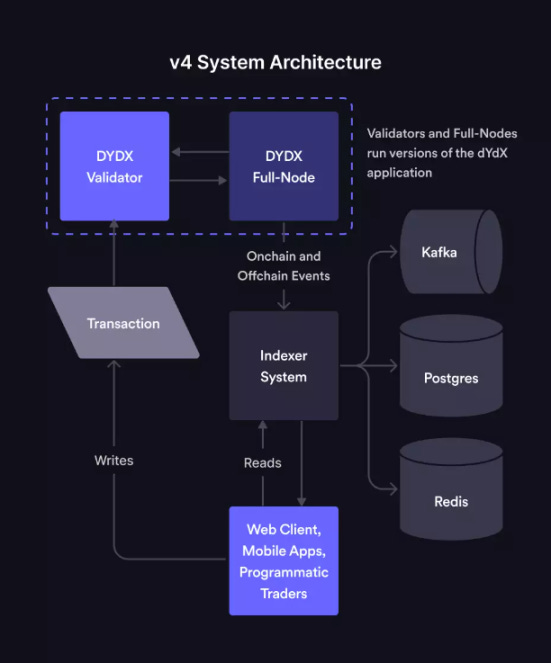

By leveraging the infrastructure of StarkWare, dYdX has carved out a unique niche in the decentralized exchange market. However, dYdX aspires to achieve a fully decentralized mode of operation, so it has decided to launch a dedicated chain based on the Cosmos SDK to manage order books and other operations in a fully decentralized manner. The dYdX V4 is designed to be fully decentralized from end to end, with the front end being run by the dYdX Operations SubDAO and the order book and matching engine being managed by global active validators.

Specifically, when users conduct transactions at the front end, their orders are routed to validators, who then broadcast the transactions to other validators and full nodes to update the order book. The consensus process selects a validator as a proposer, who is responsible for matching orders and adding them to the next proposed block. If the proposed block passes the consensus process and is confirmed by more than two-thirds of the valid nodes, it is submitted and saved to the on-chain databases of all valid nodes and full nodes; otherwise, it is rejected. After submission, the updated on-chain data is transferred from the full nodes to the indexer, and finally provided to the front end and other external services via API and Websockets.

Currently, dYdX has open-sourced its V4 code and plans to focus on building unlicensed markets in 2024, including allowing users to list any market at any time, providing instant liquidity through LP vaults, etc., in order to further improve core trading functions and user experience. In terms of security, the dYdX V3 currently holds a security level of STAGE 1 on L2Beat.

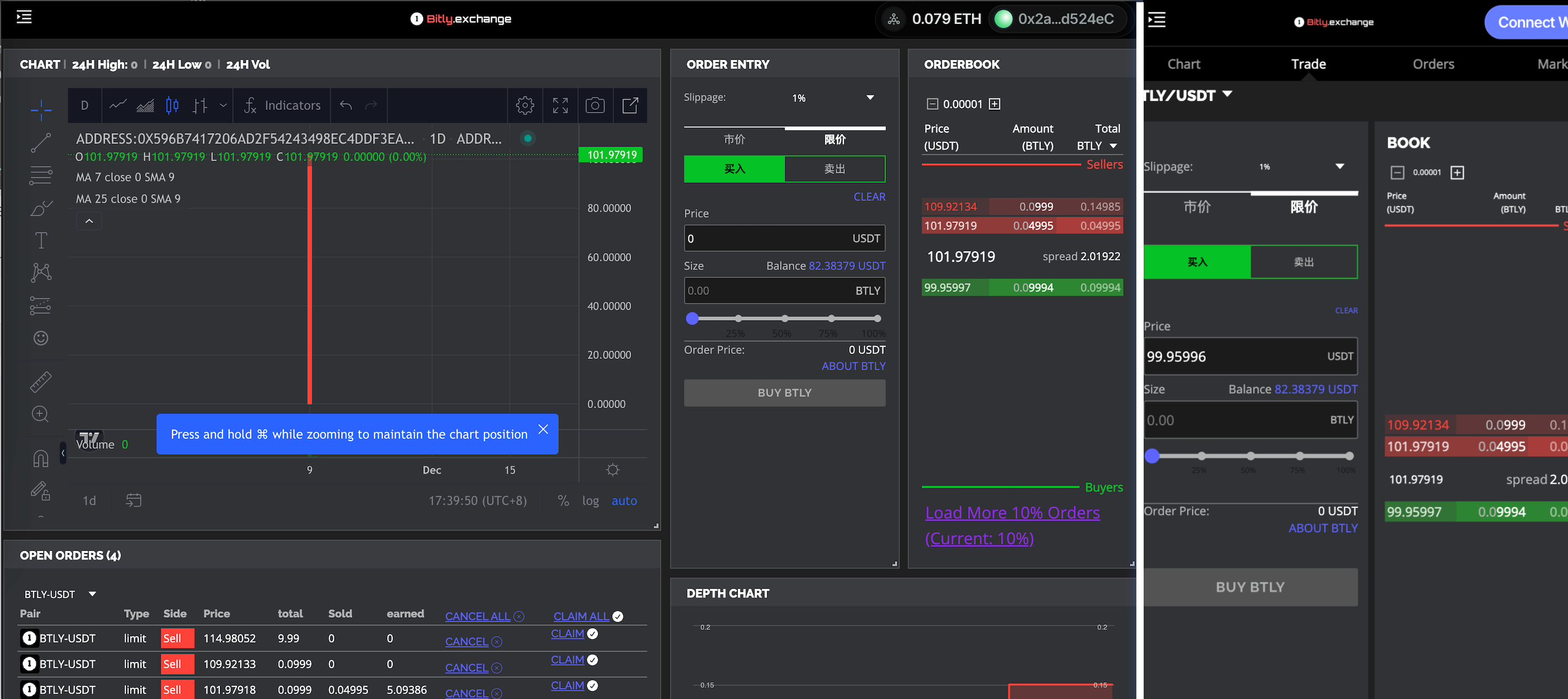

Bitly Exchange: An Innovative Model of the All-on-chain Order Book Exchange

Bitly Exchange, as an all-on-chain order book exchange, possesses unique architectures and remarkable advantages.

In terms of architecture, its all-on-chain design implies that all trading links, including order issuance, matching, and execution, are completed on the blockchain. This design ensures the transparency and immutability of transactions, with each transaction being clearly recorded on the blockchain ledger, allowing users to trace and verify at any time. Unlike some exchanges that rely partly on off-chain processing, Bitly Exchange is free from the risk of inconsistent off-chain and on-chain data, thus providing users with a completely trustworthy trading environment.

In terms of trading functions, the order book system of Bitly Exchange is highly flexible. It supports various types of orders, such as limit orders, market orders, and stop-loss orders, all of which can be processed efficiently. Moreover, through advanced algorithm optimization, the order matching speed is extremely fast, capable of meeting the trading needs of a large number of users simultaneously. Even in the face of significant market fluctuations and frequent trading, it can ensure the stable operation of the trading system without any delays or lags. Security is of utmost importance to Bitly Exchange. It employs multi-layer encryption technologies to safeguard users’ assets and trading information. Firstly, users’ private keys are strictly encrypted and stored, accessible only to the users themselves, thereby preventing the risk of asset theft from the root. Secondly, during the trading process, each transaction requires multi-signature verification to ensure that the initiation and execution of the transaction are legitimate operations authorized by the user. Additionally, the exchange conducts regular security audits to promptly detect and repair any potential security vulnerabilities, thereby ensuring the security of the trading platform.

For user experience, Bitly Exchange has also been meticulously optimized. The interface design is simple and intuitive, enabling both novice users and seasoned traders to get started with ease. At the same time, it provides a wealth of trading tools and data analysis functions to assist users in formulating better trading strategies. In terms of trading fees, through optimizing the trading process and cost structure, Bitly Exchange maintains a relatively low level of handling fees, reducing users’ trading costs and enhancing their trading enthusiasm.

For developers, Bitly Exchange also presents numerous appealing advantages. Here, developers can carry out unregulated token listings. Unlike some other exchanges, listing tokens on Bitly Exchange only requires the payment of gas fees, with no other additional cost requirements. Moreover, there is no need to add a significant amount of stablecoins as initial liquidity as in AMM exchanges, and there is no need to worry about impermanent loss. This token listing model provides developers with a more relaxed, convenient, and low-cost token listing environment, helping various high-quality projects to be displayed and developed more smoothly on the platform.

The $BTLY token occupies a crucial position in the ecosystem of Bitly Exchange. Whenever traders generate transaction fees on the platform, these fees will be randomly distributed according to the user’s share of holding $BTLY tokens. This means that as long as you hold $BTLY tokens, you are equivalent to becoming a shareholder of Bitly Exchange and can truly enjoy the dividends brought by the continuous development of Bitly Exchange. This mechanism not only incentivizes users to hold $BTLY tokens but also further promotes the prosperity and development of the entire Bitly Exchange ecosystem.

For more activities and developments of Bitly Exchange, please continue to follow our official channels:

Twitter(X): https://x.com/bitly_exchange

E-Mail: bitly.dex@gmail.com

##Summary

From BitShares to Bitly Exchange, we can clearly observe the evolutionary journey of the order book DEX. Initially, projects simply transplanted the traditional order book model onto the chain. With the passage of time and the development of the market, problems such as high gas fees and poor user experience gradually emerged. Against this backdrop, various projects began to continuously explore new trading models to address these pain points. For example, Loopring combined the order book and AMM models and brought unique experiences to users through differentiated development; dYdX focused on the derivatives market and launched a dedicated chain; Bitly Exchange chose to provide users with an experience similar to that of a centralized exchange while ensuring extreme security. We have reason to believe that with the continuous progress of technology, the user experience of the order book DEX will be further enhanced.